Image: "I Dream of Jeanie" Scream Gems, NBC Universal

Tesla just announced 14,000 layoffs. With layoffs looming and AI booming, will the U.S. Corporations continue to grow or backslide into a doom spiral?

“Make it so Simple Skippy the Chimp Understands”

My first Skippy encounter was in my supervisor’s office. I was a newly minted Sales Ops manager responsible for crafting sales and communication plans to a team of contracted part-time salespeople. Having part-time contractors in place of full-time employees was a first in our company. My supervisor always used a metaphor to describe how we should communicate a sales plan to a group of people who had less invested in our company than their predecessors. My supervisor would say, make the communication so simple that “Skippy the Chimp” could understand it and carry out the plan. I know it's not as politically correct, but Skippy stuck. I could have visualized Skippy sitting on my supervisor’s desk tossing his papers around. I always saw the chimp from the “I Dream of Jeannie’s Fly Me to the Moon” episode. Only that chimp’s name was not “Skippy” it was “Sam”, an adolescent chimp in an orange jumpsuit who Jeannie accidentally changes into a human with a wink and wiggle of her nose. Of course, this was no monkey business as I continued to manifest Skippy into other areas of my reality.

Image: Dylan Labrie, Midjourney

According to the Bureau of Labor Statistics, in 2000, employers laid off about 1.2 million workers in 5,622 mass layoffs. In 2022, over 17 million workers lost their jobs.

Image: "Corporate Profits 2000-2022" Statista

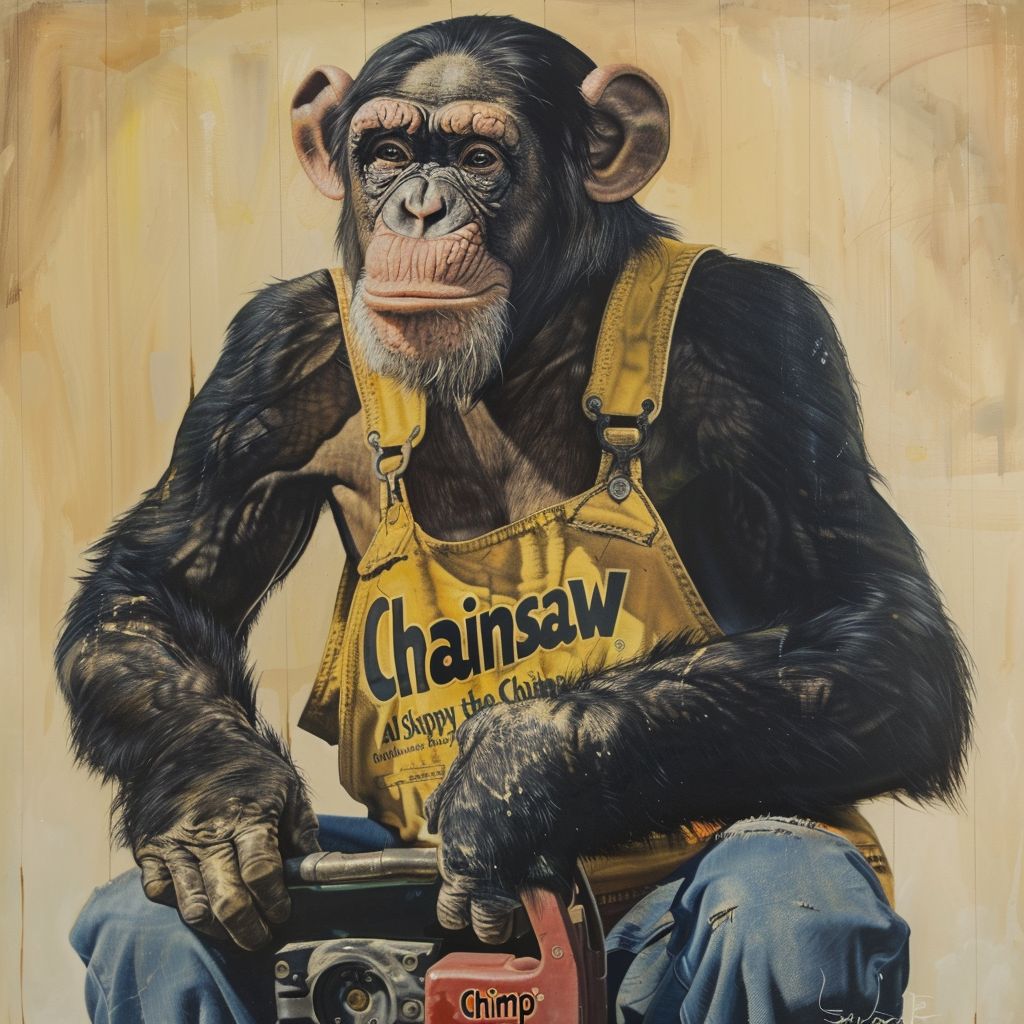

Chainsaw Al Cuts His Way to Profitability

Around the time my manager introduced me to “Skippy”, there was a CEO named Albert Dunlop who became famously known as “Chainsaw Al” for his ability to take the helm of a company and quickly turn it around. I first read about Al in Business Week while flying Northwest Airlines, when airlines provided printed copies of magazines to read on the plane. The article described how Dunlop took Scott Paper Company from a 2.5 billion dollar market valuation in 1993 to 9 billion in 1995. He more than tripled the growth in less than three years. He justified much of it by firing over 70 percent of the management as part of a total reduction of 11,200 jobs or 35% of the payroll. My first thought was, “Heck, that’s not organic growth, any warm body cut jogs. Skippy the Chimp could do that”!

Image: Dylan Labrie, Midjourney

Next, Al Dunlop took his hack job to Sunbeam, a small kitchen appliance maker. He immediately laid off half of Sunbeam’s 12,000-person global workforce, however, the positive returns were elusive this time and the Sunbeam board fired Dunlop in 1998 for hiding information concerning the company’s declining financial condition. Sunbeam went bankrupt in 2001. A year later Dunlop was permanently banned from any public company and paid fines from a shareholder class-action lawsuit and a Securities and Exchange Commission charge. In the end, Chainsaw Al may have shown himself a worse performer than Skippy.

Image: Dylan Labrie, Midjourney

Shareholders vs. Stakeholders

The stellar rise and fall of “Chainsaw Al” may have been a precursor to a new period of U.S. corporations broadening their focus beyond shareholder wealth only and being more inclusive of stakeholders. In the summer of 2003, the MIT Sloan Management Review published “The Shareholder vs. Stakeholders Debate”. The article credited economist Milton Friedman in 1970 for being one of the forces that got CEOs to rethink their obligations to delivering shareholder wealth above all as most important. I recall learning in Management 101, and Econ 101 the same thing, the purpose of the corporate enterprise was to deliver shareholder value. The MIT article asked the question, “Should companies seek only to maximize shareholder value or strive to serve the often conflicting interests of all stakeholders”? The article did a good job of weighing the pros and cons of both the Shareholder and Stakeholder options. The article concluded that there was value in both by acknowledging steps CEOs could take including to moderate the usage of terms like “maximizing shareholder value” with “maximizing our company’s contribution to our economic system”. The early 2000s to mid-2000s saw the kindling of changes in the way CEOs and U.S. Corporations began articulating their economic “footprints” to be broader than just those of shareholders, but to include many key stakeholders.

Image: Dylan Labrie, Midjourney

Labor is the #1 Cost

When you consider, the cost of human capital and labor is typically the largest line item on every corporation's balance sheet, it is no surprise the willingness of CEOs to continue to pull the layoff lever despite any shareholder and stakeholder debates of the past. In our post-COVID world, we have entered a new normal of daily layoff announcements as the shareholder vs. stakeholder pendulum has swung back in the shareholder’s favor. And despite any efforts by the government, we legally treat corporations as people in the U.S., and unlike everyday people, corporations have legions of tax lawyers and accountants who can help them offshore any resources or profits that become too costly to carry in the U.S. and thus easily negating any government stake in the process.

Questions in the Face of Change

We are at the precipice of massive change. Layoffs loom larger than ever behind pending waves of AI and machine learning beginning to nibble away at the fringes of almost every existing corporate role, including the CEO. Would we be too provocative to assume all corporations could invoke their fiduciary rights to shareholders and shrink to a CEO supported only by a small skeletal crew of C-suite management and AI agents? What would that mean? Surely profits would skyrocket in the short term with the immediate savings in labor and personnel cuts. What about the other stakeholders besides the shareholders such as the communities? Would the communities where these corporations operate decline commiserate with the loss in jobs and revenue? What happens to the cost and burden of maintaining these declining communities when the corporations that operate in their midst are now skeletons of their former selves? Would the U.S. landscape become littered with Eastman Kodak in Rochester, NY type scenarios (or pick any city that once was home to a booming corporate tax base now in decline…Flint, Toledo, Akron)? These questions have been asked and will need to be answered even more in the future.

If there is one consistency we can no longer count on CEOs playing “Skippy the Chimp” to save corporations and their jobs. CEOs simply relying on layoffs will inevitably have fate (or the “community stakeholders”) catch up with them similar to how it did with Al Dunlop. You have to add value beyond simply pushing the layoff button in a vacuum. Layoffs will always be a key enabler as long as expensive human capital exists. When the corporation becomes singularly dependent on it in a short-term sense it only exacerbates the potential for long-term anemic to flat growth and decline due to dependency on a short-term fix.

Binary is for the Chimps

The answer here is neither stakeholder nor shareholder as much as it is a little bit of both. The MIT article also pointed out that people have misinterpreted the stakeholder and shareholder value. Even Milton Friedman was not against a corporation spending a portion of its profits towards a charitable cause, as long as its end result still helped to lift the overall profitability of the corporation. This is something many corporations have figured out in incorporating ESG into everyday operations.

We Need To Tap Into Our “Super” Power

Taking a binary approach is akin to playing Skippy. A chimp or gorilla can take the easy way out and visually identify the difference between a ‘0’ or ‘1’, but it is the nuance that requires a little “extra work” in human intellect and intervention. This is a “super” power we all hold above any Skippy or AI LLM.

The Good “Corporate Citizen”

In terms of stakeholder value, corporations will need to be more vigilant than ever to balance the needs of stakeholders. If in a country where we treat corporations as people, it is time for more corporations to continue to act as good corporate citizens. No longer can corporations turn their backs on the communities with which they operate as the gap between rich to poor has become so great and decisive that it will only alienate and endanger the corporation more. In 1961 Jane Jacobs wrote a timeless book “The Death and Life of Great American Cities” and one part of her recommendation for building great cities is that it takes everyone who lives in a specific neighborhood to be involved from picking up trash to policing each other in humane ways. This should also include our corporate citizens.

Photo Credit: Dylan Labrie

Detroit or “Bust”

I recently experienced a great living and live example of stakeholder value in a visit to the great American city of Detroit. I moved to Detroit for my first promotion in the early 90’s. The day I was waiting for my Detroit flight (a city I had never visited before), I was reading the print version of US Today, and on a banner on the front page was “Thundersnow Expected in Detroit Today” a reference to the weather section of the paper and the very blizzard I was flying into in Detroit. On the second page of the paper was a black-in-white photo of what appeared to be a homeless man with a “will work for food” cardboard sign standing in front of the Fisher (General Motors HQ) building in the New Center area of Detroit with a caption announcing GM was laying off more employees. I mention this to contrast with my recent visit to Detroit which has rebuilt and renewed itself into a renaissance city. Ford Motor Company is rehabilitating the long-vacant massive eyesore of the Michigan Central Station building to hometown boy, Dan Gilbert building a 1.5 million square foot 45-story skyscraper on the former derelict and one-time iconic site of the J. L. Hudson’s department store. These are two projects that will not only help further cement Detroit’s renaissance, but they will benefit the contributing companies in multiple key stakeholder supporting ways including recruiting and goodwill within their hometown.

One of the news stories while I was in Detroit was concerning GM moving their HQ from Detroit’s Renaissance Center to the new Hudson’s Tower. I read an opinion piece where the opinion was that hopefully, GM would be a good corporate citizen in vacating the Renaissance Center. The concern was they could leave it without an exit plan and the city be left with a hulking vacant riverfront building. This is best relatable to me when I drive across this great country of ours and I see the landscape littered with a whole generation of former nineties-era big box stores. It is like the tale of two cities as I witness some great examples of repurposed big box stores and others where they still sit empty and boarded up amongst dying strip shopping centers. The difference is usually predicated on a combination of civic and corporate coordination, but usually if an older store is vacated and unchecked by concerned citizens and civic stakeholders, the vacator will do nothing, leaving it empty in place. Fortunately, some retailers have made having appropriate exit plans in place a cornerstone of their retail strategy.

How We Will Win in the Future

What the metaphor of Skippy the Chimp teaches us is beyond the simplicity of communication, it's the complication of humanity. In the face of massive layoffs and AI incursion, what we all have to be thinking from CEOs to frontline workers is, "How can I think beyond the binary ‘0’s and ‘1’s that an AI model or a Chimp can understand to the nuance of all the real numbers in between that are better understood by a sentient human being". That is the way we will all continue to win in the future.

Subscribe and Get 10% Off Your First Year of Google Workspace

If you enjoyed reading this edition and would love to read more, please consider subscribing.

Also, I created this blog on Google Workspace Docs, just as I create and collaborate with the help and ease of using Google Workspace. You too, can enjoy the benefits of Google’s cloud storage and apps in Google Workspace with the 10% off the first year starter promotion code below.

Google Workspace Business Standard |

97KGFLTUUWE7EL6 |

Each promotion code provides 10% off the first year on either the Google Workspace Business Starter plan and the Google Workspace Business Standard plan.